[youtube=http://www.youtube.com/watch?v=b9FIgT-DYOw&w=420&h=315]

The idea of rebalancing may seem counter intuitive to most people. Basically it means selling the parts of the portfolio that have been doing the best and buying the ones that have been doing the worst. In the spring of 2009 it would mean selling your safe bonds (the investments outperforming on a relative basis) and buying stocks (the investments that have been tanking). Today it would mean selling stocks (especially US small cap value stocks) and buying bonds and emerging market stocks. Fear or greed, if the market is declining or rising, respectively, normally cloud an individual investor’s decision to rebalance. Today we will discuss examples of rebalancing and why it is important to implement regularly in order for a portfolio to be successful.

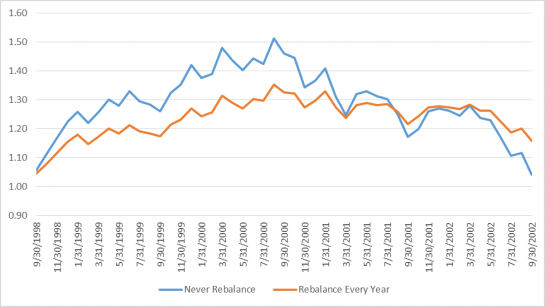

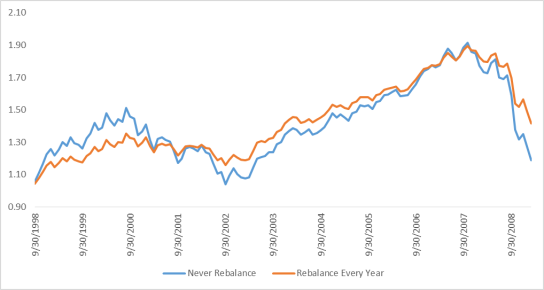

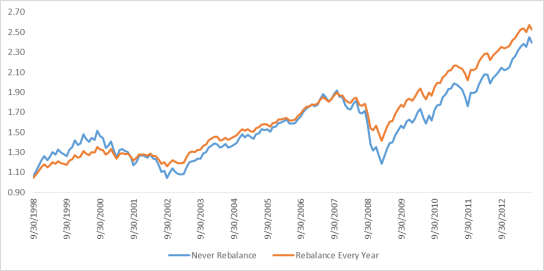

Let’s examine a portfolio made up of 50% Russell 3000 (Equities) index and 50% Barclays US Aggregate Bond Index over the last 15 years. We will compare two portfolios, one rebalanced every year and the other never rebalanced; we will use a time period from September 1998 through August 2013.

As the technology sector took off in 1998 you would be have been happy you didn’t sell your stocks to buy more bonds. By August of 2000 the non-rebalanced portfolio was up over 51% while the rebalanced portfolio was only up about 35%.

This large outperformance of the Russell 3000 concentrated the risk in the portfolio. By August 2000 the non-rebalanced portfolio is now holding about 60% of its assets in the Russell 3000 and only 40% in the Aggregate Bond Index. As the technology bubble burst, this concentration lead to a larger loss for the non-rebalanced portfolio. By September of 2002 the non-rebalanced portfolio is only up about 4% while the rebalanced portfolio is up over 15%.

Because of the large drop in the Russell 3000, the non-rebalanced portfolio is now concentrating its risk in safer bonds: 40% in the Russell 3000 and 60% in the Aggregate Bond Index. As the market recovers in the mid-2000’s the non-rebalanced portfolio is under-invested in stocks. By September of 2007 the non-rebalanced portfolio finally catches up with the rebalanced portfolio. The total return for both portfolios is about 88%, or 7.2% per year.

The non-rebalanced portfolio is finally back up close to the original portfolio weights with about 55% in the Russell 3000 and 45% in the Aggregate Bond Index. Of course the good times can’t last forever and the financial crises of 2008 arrives. Since the non-rebalanced portfolio never locked in any gains by selling stock it suffered a larger loss. The non-rebalanced portfolio lost over 37% while the rebalanced portfolio lost only 25%. By February 2009 the total return of the rebalanced portfolio was about 42% while the non-rebalanced portfolio’s total return was only about 19%.

Once again at the bottom of the market the non-rebalanced portfolio is underinvested in stocks with the Russell 3000 only making up about 35% of the portfolio. This once again leads to underperformance as the market recovers. By August 2013 the non-rebalanced portfolio is still lagging behind the rebalanced portfolio with total returns of about 13% less than the rebalanced portfolio.

The above describes what is sometimes referred to as the “Rebalancing Bonus”. In volatile markets a properly rebalanced portfolio can have a higher return than the weighted average of its parts. In our case the during this time period the Russell 3000 returned 6.22% per year and the Aggregate Bond Index returned 5.36% per year. Our rebalanced portfolio returned 6.38% per year, higher than the Russell 3000 with less than half as much volatility. Below is a chart of our rebalanced portfolio and the Russell 3000.

I want to be clear that while rebalancing a portfolio can be a benefit in some markets, the main benefit is controlling the risk. Without rebalancing, your portfolio can become too aggressive in bull markets and too conservative in bear markets. Without controlling these risks you can be setting yourself up for unintended consequences.

Setting up a rebalancing schedule is the best way to force you to be disciplined in your actions and not succumb to the noise of the day. As opposed to a calendar schedule as I use in the example above, a better approach is selecting targeted ranges of each asset class and rebalancing when an asset falls outside this range. At Grand Street Wealth Management, we use different ranges for different assets based on their forecasted volatilities. A good general rule of thumb is “5/25”. Major asset classes such as stocks and bonds are allowed to fluctuate ±5% from each other before rebalancing. For a 60/40 stock/bond portfolio stocks would have to fall below 55% or above 65% to trigger a rebalance. Within an asset class, such as US stocks and international stocks, each asset can fluctuate 25% from its target. For example, if the 60% stock allocation above was broken down into 30% US stocks and 30% international stocks we would allow our US stock allocation to drift between 22.5% and 37.5% (±25%) before rebalancing.

Rebalancing comes with costs, mainly transaction cost and taxes. Below are some rules of thumb to minimize these costs:

- Use new cash first to rebalance

- Try to avoid short-term capital gains, if possible, in taxable accounts

- If you must take capital gains consider rebalancing back to the lower range limit instead of the target allocation

- Rebalance in tax-deferred accounts first

Rebalancing is a true test of will. The first step is deciding how much risk you are comfortable with. I find that people tend to be real comfortable with risk in good times and scared of risk in bad times. A true understanding of the portfolio you own needs to occur. Once you understand the real risk you are taking and are comfortable with that risk, sticking to your plan with rebalancing is almost always the right strategy in order to maintain that pre-determined amount of portfolio risk.