I received many responses from my last post about how Delta Pilots’ new Defined Contribution (DC) plan stacks up against the old Defined Benefit (DB) plan. First, I would like to thank each of you who responded. I appreciate that you took the time to ask questions. Today I will answer some questions that I heard from a few readers to clarify some points I made last week.

Question #1: Would you want to go back to a Defined Benefit Plan?

The simple answer to this question is no. I think we all realize the danger in having our retirements not be in our own names. That said there are some flaws with the current retirement plan that need to be addressed. I highlighted in the last article that the amount of funding Delta now contributes to a pilot’s 401K provides a benefit that is much less than it provided in the old DB plan, even with career assumptions that many of you thought were very optimistic. In a career like this one, where a health problem can take it away overnight, having a strong retirement benefit to fall back on is very important.

Another issue with the current retirement plan is the sequence of returns risk that I described in the last article. I will explain more fully in the next question.

Question #2: Why is there such a large difference between receiving a “constant real return” and a “varying return” over time?

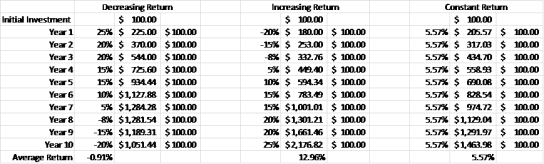

To drive this point home, let’s look at some examples. Let’s say you have an investment that has historically provided you with a 5.57% real (i.e. after inflation) rate of return and assume this is a realistic estimate of its future return. Of course we would not expect the returns to always be exactly be 5.57% every year, but if they average out to be 5.57%, can’t we just use that number to do our planning? Not quite – there are many ways an investment can eventually average to 5.57% return.

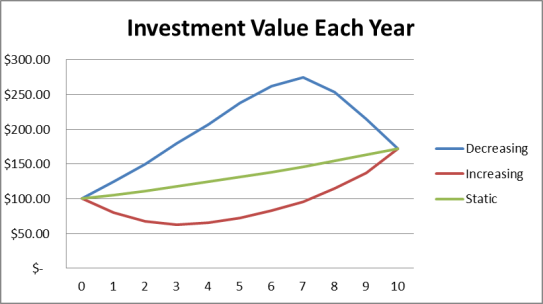

In the table above there are three different streams of returns. The first one starts with very good returns, then has poor returns at the end. The second is the opposite with bad returns early on, with good returns at the end. The third has a constant rate of return. We started with $100 and averaged the same rate of return in all three examples so we ended with the same amount of money in each case: $172.01.

So what’s the problem with using the average? The problem comes in when you start adding annual contributions into the mix. Let’s say we make an additional investment of $100 every year.

Now the results are very different. In the first case with “Decreasing” returns we only ended up with $1,051.44 – about half as much as we did in the second case with “Increasing” returns! So even though we had an investment with the same average returns over time, we ended up with half as much money because of when we got those returns. When we factor the cash flow into our rate of return calculation we get much different numbers. The first scenario actually had an overall rate of return of -0.91% even though the initial investment he owned had a return of 5.57%!

In the first example the average return is called the Time-Weighted Return. It is the return you see when you look at the performance of a mutual fund or other investment. In the second example the average return is called the Dollar-Weighted Return. It is the return the investor actually earns on his money.

This is why we need to increase our 401K funding from 19% to 28% in the last article to get us to a high enough confidence level to achieve our investment goal. When we get those returns is very important, and the Monte Carlo simulation does a good job of showing this point.

This is also why I spend so much time trying to build portfolios that lower the overall volatility of the portfolio. If you are able to reduce the volatility of your returns, while keeping the average return the same, there is less of a chance you will get the really bad returns at just the wrong time.

Question #3: Do you recommend buying an annuity at retirement?

To put another way: should you annuitize your entire portfolio at retirement? The answer is generally no. There are cases where annuitizing a portion of your portfolio makes sense, but that decision would be made on a case by case basis and is beyond the scope of a simple answer. In my last post I referred to buying an annuity that gave you 60% FAE, but that was just a way to compare the two retirement systems. That should not necessarily be the goal to reach. I do believe, however, that the average person would be better served if they viewed their 401K accounts in terms of how much long-term income could be withdrawn as opposed to simply how much money is in the account. I think most people don’t realize how much a 401K account with $300,000 in it will be able to support them in retirement.

If you have any other questions, keep them coming!