[youtube=http://www.youtube.com/watch?v=R3KvzeJppcA&w=420&h=315]

Consistently beating the market is very hard to do. There are, however, a few investors that have shown they have the skill to do it. But how do you know if an investor is skillful or just lucky? We can turn to statistics for the answer.

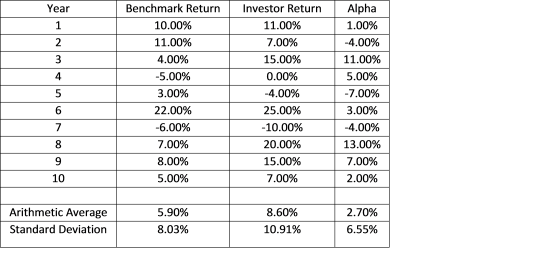

Below is a table of a hypothetical investor’s performance relative to an appropriate benchmark (in another post we will discuss how to find an “appropriate benchmark”). His alpha, or outperformance, is shown in the right most column.

Here is a chart of the investor’s performance versus the benchmark.

Here is a chart of the investor’s performance versus the benchmark.

Our investor has beaten the market over this 10 year period. A $100,000 investment in the benchmark yielded $172,900 and our investor yielded $217,817. Is it because of his skill, or he is just getting lucky? In other words, what is our level of confidence that he can do it again? To answer, we will compute the amount of time this investor will have to keep this level of performance to be statistically confident he is skillful. Here is the eqution:

Where:

Where:

- Tstat = a number representing a certain confidence level. The higher the number the more confident we will be. Normally a value of 2 is used because it shows confidence at the 95% level.

- N = the number of periods, in this case years

- STD = the standard deviation of the ALPHA

- ALPHA = the average alpha between our investor and his appropriate benchmark

Now we will solve the equation:

![]()

That’s right, our investor will need to keep this level of outperformance up for another 13.5 years before we will know for sure (we’re 95% confident) his returns are due to his skill.

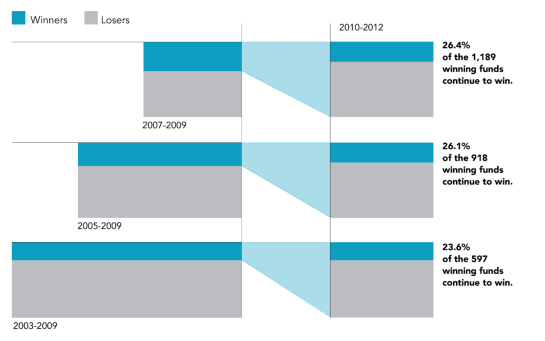

It is important to know if an investor is lucky or skillful because luck can easily run out. We see this all the time on Wall Street. Below is a chart compiled by DFA using CRSP data. It shows the performance of US actively managed mutual funds. On the left side we see the “Winners”, those that beat their benchmark, over three-, five- and seven-year periods. We then look to see how those “Winners” did over the next three years. As you can see only about a quarter of the funds continued to outperform in the subsequent 3-year period. Also, it did not matter if we looked at longer periods of outperformance, up to seven years, before labeling a fund a “Winner”. Obviously there was a lot of luck running out. If most of those managers were skillful we would see more consistent outperformance.

The take away from this example is that you need a lot more time to distinguish luck from skill than most people think. Not surprisingly, it is common for people to attribute luck to skill — it’s been shown that mutual funds typically raise more money during their peak performance years and generally don’t perform nearly as well in the years that follow!