Deciding when to take social security is a big decision for someone about to retire. Most people realize that they can take social security as early as age 62; however, their annual ongoing benefit may vary by up to 30% depending on when they elect to receive it. Many conclude that they should wait until full retirement age (66-67 years old depending on the year you were born) to elect receiving social security. Today I will attempt to show that for most, waiting until age 70 is even more beneficial.

For example, Ed is about to turn 66 years old; his full retirement age for social security. His PIA, or primary insurance amount, is $23,902 per year. He also has $500,000 saved inside of his 401K. His plan is to spend $45,000 per year, and each year he will give himself an inflation adjusted retirement income. We’ll also assume that:

• Inflation of his spending goal and of his Social Security benefit rise at 3% each year

• He will withdraw his 401K money at the beginning of each year

• His 401K account will appreciate at 5% each year

• Ed is in good health

• Ed’s spouse Ellie is the same age as Ed and has not earned her own benefit

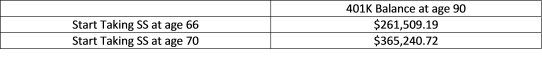

In order to delay taking social security until age 70 while retiring at age 66, he would have to fund his entire spending goal out of his 401K for the first 4 years. At age 70 his 401K account will be significantly lower, but his Social Security Benefit will be much higher. Below is a table showing the two scenarios when Ed turns 70:

So which scenario is better? To answer this question we can project the two scenarios into the future. Below is a chart of Ed’s 401K balance from age 66-95:

As you can see, both lines eventually decrease as taking larger 401K withdrawals to keep up with inflation starts to turn both balances lower. But, by waiting until age 70 to start taking Social Security Ed can take less out of his 401K every year. Below is what both scenarios would look like at age 75.

You can also see from the graph above that the breakeven point is about age 84. It turns out that according to the Social Security Administration’s actuarial tables, at age 70 Ed has an expected life span of 14.03 years (Ellie’s is 16.33). If Ed lives as long as the average person, he would break even — so why would he wait to take Social Security?

The answer lies in what the real risk is. The risk is NOT that Ed dies too early and doesn’t get as much Social Security benefits as he otherwise would have. The real risk is Ed living too long and running out of money. Let’s say at age 90 Ed must enter an assisted living home. Below is his 401K balance in our two scenarios:

Ed has over $100,000 more to help cover the costs of the facility, which typically cost $5,000 per month or more. Once Ed is out of money the choices become pretty bad. Either he must rely on family to help cover the costs or turn to Medicaid and be placed in a state run facility.

Essentially what Ed has done is taken the first four years of potential Social Security payments and purchased an annuity. Social Security will pay Ed an incremental $8,609 at age 70 (versus receiving at age 66). In this example, if Ed took Social Security at age 66 his first four years of benefits would have totaled $100,000. Effectively, by foregoing the $100,000, he receives an annuity at 8.6%. If Ed took this amount and instead bought an equivalent annuity in the private market (indexed to inflation, passed 100% to his spouse at death) the best deal I could find for a 70-year-old was $4,096 per year — just 4.1% per year. By waiting until age 70, Ed receives an annuity giving him over double the returns he would receive in the private market.

Ed’s wife Ellie is entitled to a spousal benefit equal to 50% of Ed’s Social Security benefit. Unfortunately her benefit does not increase with delayed retirement credits. They can, however, utilize a technique known as “File and Suspend”.

When Ed reaches age 66 (his full retirement age) Ellie has reached the maximum spousal benefit she can accrue. For Ellie to receive these benefits Ed must file for social security. He would then choose to immediately suspend his own benefit. This will allow his Ellie to file for her benefits immediately while Ed continues to accrue benefits. Survivor benefits DO include delayed retirement credits, so if Ellie outlives Ed (the most likely scenario) she will enjoy Ed’s higher benefit for the remainder of her life.

Deciding when to take Social Security is a very complex and important decision. There are many factors that you must take into account. Generally speaking though, if you are in good health and you can afford it in the short term, waiting to claim Social Security benefits is the best option.

Additional Info

In our example above we assumed that the money inside the 401K account started at $500,000 and grew at 5% per year. As a result, Ed would have the same amount of overall savings in both scenarios at age 84. It is worth noting that if we assumed Ed had NO savings and relied solely on Social Security benefits, the cumulative Social Security benefits would break even at age 79 — see chart below: